Insightful Perspectives

Explore a world of engaging news and informative articles.

Whole Life Insurance: Your Ticket to Eternal Peace of Mind

Discover how whole life insurance can provide lasting security and peace of mind for you and your loved ones. Secure your future today!

Understanding Whole Life Insurance: Benefits and Features Explained

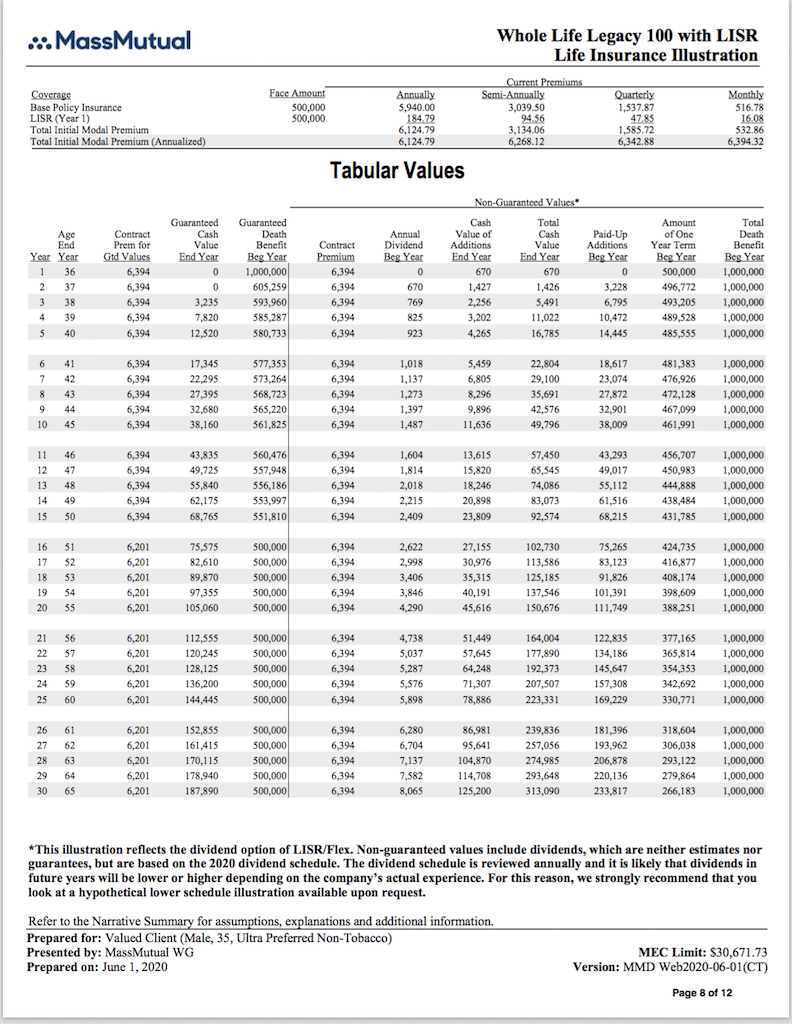

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire lifetime, as long as premiums are paid. One of the key benefits of whole life insurance is its cash value component, which grows over time at a guaranteed rate. This cash value can be borrowed against or even withdrawn, providing policyholders with a financial safety net. Moreover, whole life insurance often comes with level premiums, meaning the cost will not increase as the insured ages, making it a stable long-term financial product. For more details about how it works, you can visit Investopedia.

Aside from the predictable premiums and cash value accumulation, whole life insurance offers significant death benefits that can ensure financial security for beneficiaries. This can be particularly beneficial for families looking to cover expenses such as mortgages, education, and living costs after the policyholder’s passing. Additionally, whole life policies often provide dividends which can be reinvested to enhance the policy's cash value, used to pay premiums, or taken as cash. For further reading on the advantages of whole life insurance, check out NerdWallet.

How Whole Life Insurance Provides Financial Security for Your Loved Ones

Whole life insurance is a powerful tool that offers unparalleled financial security for your loved ones in the event of your untimely passing. Unlike term life insurance, which provides coverage for a limited period, whole life insurance provides lifelong protection, allowing you to accumulate cash value over time. This accumulation means that a portion of your premium payments contributes to a cash fund that grows tax-deferred, enabling you to access this money in times of need. As a policyholder, you can be assured that your family will receive a guaranteed death benefit that can help cover essential expenses such as mortgage payments, education costs, and everyday living expenses.

Investing in whole life insurance also provides peace of mind, as it functions not only as a safety net for your beneficiaries but also as a financial strategy. Many people view whole life insurance as a means of inter-generational wealth transfer, allowing you to leave a lasting legacy for your heirs. This policy can be an effective way to manage estate taxes and ensure that your loved ones receive the maximum value from your estate. For further insights on how whole life insurance can bolster your family's financial security, you can check sources like NerdWallet and Investopedia.

Is Whole Life Insurance Right for You? Key Factors to Consider

Deciding whether whole life insurance is the right choice for you involves evaluating several key factors that can affect your financial situation in the long term. First, consider your financial goals: If you are looking for a policy that acts as both a safety net and a savings vehicle, whole life insurance might be suitable. It offers a death benefit while also accumulating cash value over time. However, if your primary concern is affordability, you might want to explore term life insurance options, which generally come with lower premiums.

Another crucial aspect to ponder is your age and health status. Whole life insurance premiums typically remain fixed, meaning that purchasing at a younger age can lock in lower rates, making it more affordable in the long run. Additionally, if you have health conditions, your insurability may be affected. It’s essential to weigh the pros and cons of whole life insurance against your immediate and future financial needs. By doing so, you can make an informed decision that aligns with your overall financial plan.