Insightful Perspectives

Explore a world of engaging news and informative articles.

Crypto Staking Systems: Harvesting Your Wealth While You Sleep

Unlock the secrets of crypto staking and watch your wealth grow effortlessly while you sleep! Discover how to maximize your earnings today!

Understanding Crypto Staking: A Beginner's Guide

Crypto staking is a fundamental concept for anyone looking to delve into the world of blockchain and cryptocurrencies. At its core, staking involves participating in the network of a proof-of-stake (PoS) cryptocurrency by holding and ‘locking up’ a specific amount of coins in a wallet to support the operations and security of the network. In return for this contribution, stakers receive rewards, often in the form of more cryptocurrency. This process not only provides an opportunity for passive income, but it also plays a crucial role in maintaining the decentralized nature of the blockchain.

For beginners, understanding crypto staking can seem daunting. However, following these basic steps can simplify the process:

- Choose a PoS cryptocurrency that offers staking.

- Create a wallet that supports staking and transfer your coins.

- Follow the specific staking instructions provided by the cryptocurrency.

- Monitor your rewards and manage your staked assets responsibly.

As you venture further into crypto staking, you'll discover various strategies and platforms tailored to different investor needs, enhancing not only your knowledge but also your potential returns.

Counter-Strike is a highly competitive first-person shooter game that has captivated players around the world. This game requires skill, strategy, and teamwork, making it a popular choice for esports events. For those looking to enhance their gaming experience, don't forget to check out the rollbit promo code for exciting rewards and bonuses.

Maximizing Your Returns: The Best Strategies for Crypto Staking

Maximizing your returns through crypto staking can significantly enhance your investment portfolio. To begin, it’s essential to choose a cryptocurrency that offers a solid staking mechanism. Coins like Ethereum 2.0, Cardano, and Polkadot provide attractive staking rewards. A good first step is to research the staking yield and terms associated with each coin. Moreover, participating in community discussions or forums can help you gauge the stability and reliability of the staking network.

Another strategy to consider for maximizing your returns is to leverage staking pools. Staking pools allow multiple investors to combine their resources, thus increasing the chances of receiving rewards. It’s crucial to evaluate the pool's fees and reputation. You may also want to diversify your staking investments across multiple cryptocurrencies to mitigate risk while enhancing potential gains. Lastly, always stay updated with market trends and adjust your staking strategies accordingly to maintain optimal returns.

Is Crypto Staking Worth It? Pros and Cons Explained

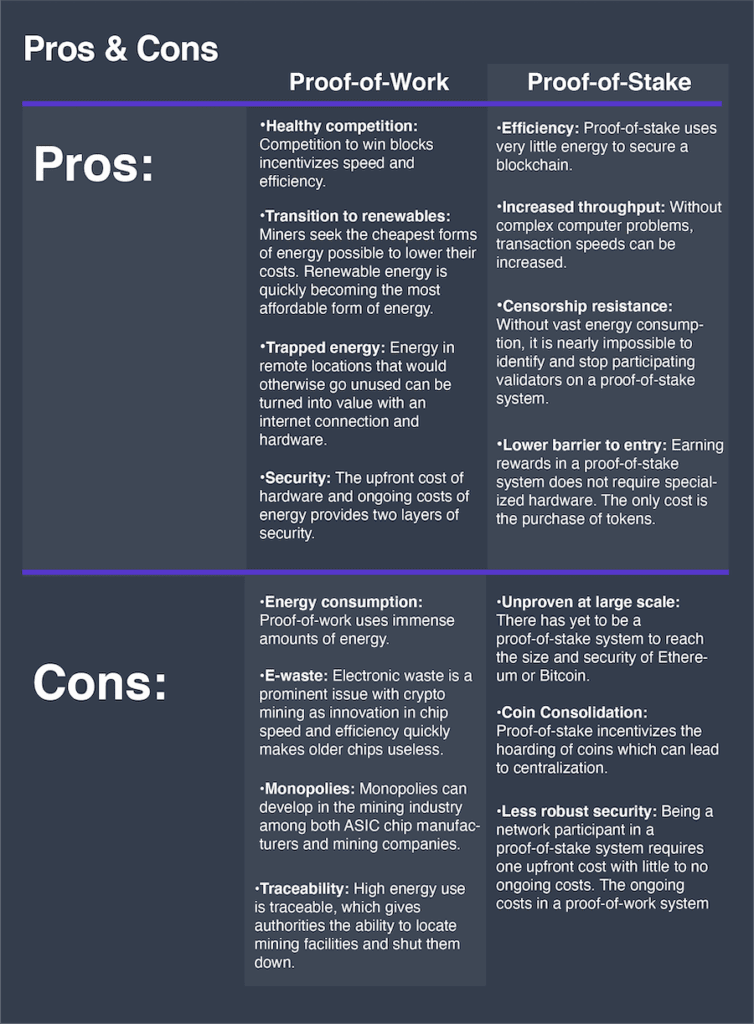

Crypto staking has gained significant traction in the world of cryptocurrency investing. It allows investors to earn rewards on their holdings by participating in the proof-of-stake consensus mechanism. Pros of crypto staking include the potential for high returns, passive income generation, and contributing to the overall security and efficiency of the blockchain network. Users can often see annual percentage yields (APY) ranging from 5% to over 20%, depending on the asset and the platform used. However, it is essential to consider some cons such as market volatility and the possibility of lock-up periods where your funds remain inaccessible for a set time.

Another important aspect to consider when evaluating whether crypto staking is worth it is the risk factors involved. Not all cryptocurrencies are created equal; some may have fluctuating values that could diminish your staking rewards. For instance, during market downturns, the value of staked assets might plummet, negating any gains from the rewards earned. Moreover, users need to be mindful of the respective platforms' reputation and the security measures taken to safeguard their assets. Ultimately, investors should weigh these pros and cons carefully and assess their risk tolerance before diving into crypto staking.