Insightful Perspectives

Explore a world of engaging news and informative articles.

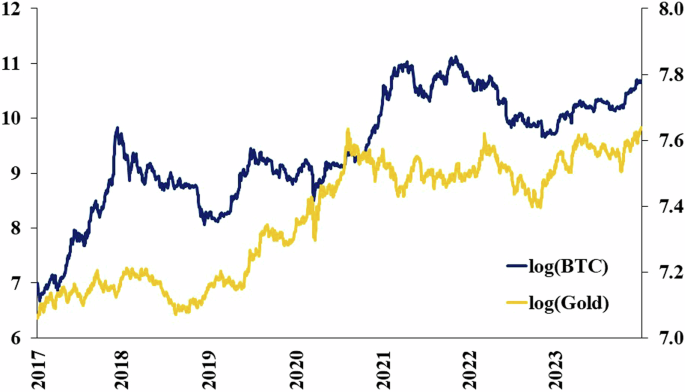

Crypto's Volatile Dance: How Market Fluctuations Shape Investment Strategies

Uncover the secrets behind crypto's wild price swings and discover investment strategies that turn volatility into opportunity!

Understanding Price Volatility: What Causes the Twists and Turns in Crypto Markets?

Understanding price volatility in the cryptocurrency markets is crucial for investors and traders alike. Various factors contribute to these unpredictable twists and turns, making it essential to stay informed. First and foremost, market sentiment plays a significant role. When investors are optimistic about a particular cryptocurrency, demand surges, leading to a rapid increase in price. Conversely, negative news or market downturns can trigger panic selling, causing a sharp decline. Other influencing elements include regulatory developments, technological advancements, and macroeconomic trends, which can further exacerbate price fluctuations.

Furthermore, the inherent characteristics of cryptocurrencies amplify their volatility. Unlike traditional financial markets, cryptocurrencies often experience lower liquidity due to their relatively smaller market capitalizations. This means that even modest buying or selling activity can result in significant price changes. Additionally, speculative trading is rampant in this new digital frontier, as many traders rely on price predictions and indicators rather than fundamental analysis. In summary, understanding the multifaceted causes of price volatility is key to navigating the unpredictable world of crypto markets.

Counter-Strike is a popular tactical first-person shooter game that has captivated millions of players around the world. With its team-based gameplay and emphasis on strategy, it offers an immersive experience that challenges players to work together to achieve their objectives. For those interested in enhancing their gaming experience, using a cloudbet promo code can provide exciting bonuses and rewards.

The Impact of Market Sentiment: How Emotions Fuel Cryptocurrency Price Swings

The impact of market sentiment on cryptocurrency prices cannot be overstated. Unlike traditional markets, cryptocurrencies are heavily influenced by public emotions and perceptions. Price swings often reflect the collective mood of investors, driven by fear, excitement, or speculation. For example, during bullish market trends, positive sentiment can cause a rapid influx of investments, which drives prices even higher. Conversely, in bearish trends, panic selling can lead to sharp declines, as negative emotions take hold and investors rush to liquidate their assets.

Moreover, social media platforms play a critical role in shaping market sentiment. Tweets from influential figures or viral posts can trigger significant price movements, highlighting the emotional nature of cryptocurrency trading. Understanding this dynamic allows traders and investors to better navigate the volatile landscape of digital assets. Incorporating sentiment analysis into trading strategies can offer a competitive edge, as it considers the emotional factors at play alongside traditional technical indicators.

Adaptive Investment Strategies: Navigating the Highs and Lows of Cryptocurrency

In the volatile world of cryptocurrency, adaptive investment strategies are essential for navigating the unpredictable market dynamics. These strategies allow investors to remain flexible, adjusting their approaches based on market trends, news events, and technological advancements. By employing techniques such as dollar-cost averaging and portfolio diversification, investors can mitigate risks while maximizing potential gains. Moreover, staying informed about regulatory changes and market sentiment can provide invaluable insights that inform timely decision-making.

Another critical aspect of adaptive investment strategies is the ability to learn from past performance. Investors should regularly analyze their portfolio and the broader market to identify patterns and insights that can guide future investments. Tools such as technical analysis and fundamental analysis play a vital role in this ongoing evaluation. Additionally, leveraging automated trading systems and alerts can help investors stay ahead of market movements, ensuring they are well-positioned to capitalize on both the highs and lows that characterize the cryptocurrency landscape.