Insightful Perspectives

Explore a world of engaging news and informative articles.

Riding the Crypto Rollercoaster: How Market Volatility Can Be Your Best Frenemy

Discover how to navigate crypto market swings and turn volatility into your greatest ally. Embrace the ride and profit from the chaos!

Understanding Market Volatility: The Ups and Downs of Crypto Trading

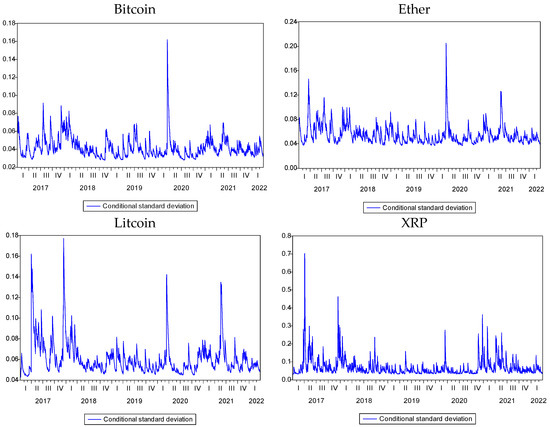

Market volatility is a defining characteristic of crypto trading, and understanding its implications is essential for both novice and experienced investors. At its core, market volatility refers to the rapid and often unpredictable changes in the value of cryptocurrencies. This phenomenon can be influenced by various factors, including market sentiment, regulatory news, and macroeconomic trends. For instance, a significant announcement from a regulatory body can trigger sharp price movements, leading to opportunities as well as risks for traders.

To navigate the unpredictable nature of crypto trading, investors should consider adopting strategies that emphasize risk management and informed decision-making. One effective approach is to stay updated on the latest news and trends within the cryptocurrency space, as they can provide valuable insights into potential market shifts. Additionally, diversifying one’s portfolio and utilizing tools like stop-loss orders can help mitigate losses during periods of heightened volatility. By understanding and adapting to the ups and downs of the market, traders can better position themselves for potential profit, despite the inherent risks involved.

Counter-Strike is a popular first-person shooter video game franchise that has captivated players since its inception. The game pits two teams, terrorists and counter-terrorists, against each other in various objectives, such as bomb planting or hostage rescue. For those looking to enhance their gaming experience, using a cloudbet promo code can provide some exciting bonuses.

Strategies for Navigating Cryptocurrency Market Fluctuations

Successfully navigating the cryptocurrency market fluctuations requires a solid understanding of various strategies that can help investors mitigate risks and capitalize on opportunities. One effective approach is to employ a diversification strategy, where individuals spread their investments across different cryptocurrencies. This method reduces the impact of a single asset's volatility on the overall portfolio. Additionally, staying informed about market trends and global events can provide crucial insights that assist in making timely decisions.

Another key strategy is to implement risk management techniques such as setting stop-loss and take-profit orders. By establishing these parameters, investors can limit potential losses while locking in profits when the market moves in their favor. Furthermore, maintaining a long-term perspective is vital; rather than reacting impulsively to short-term price swings, investors should focus on the fundamental value and long-term potential of their chosen cryptocurrencies. This balanced approach can significantly enhance one’s ability to navigate the unpredictable nature of the cryptocurrency landscape.

Is Market Volatility Your Friend or Foe? A Deep Dive into Crypto Investing

In the world of crypto investing, market volatility is often viewed through a dual lens: as a friend or a foe. On one hand, the significant price fluctuations can present lucrative opportunities for investors willing to dive into the chaos. The potential for quick gains, especially during a bull market, can lead to substantial profits for those who strategically time their buys and sells. However, with such opportunities comes the inherent risk; a market downturn can produce devastating losses just as rapidly. Therefore, understanding how to navigate these volatile waters is crucial for any aspiring cryptocurrency investor.

Conversely, some investors perceive market volatility as an adversary, arguing that the unpredictable nature of cryptocurrency prices can discourage long-term investment strategies. Many prefer the stability of traditional assets, viewing crypto's rapid ups and downs as a rollercoaster ride fraught with danger. To combat this perception, it's essential for investors to cultivate a disciplined approach, incorporating risk management techniques, such as setting stop-loss orders or diversifying their portfolios. Ultimately, whether market volatility is seen as a friend or foe depends on an investor's risk tolerance and investment goals, making it vital to tailor one’s strategy accordingly.